That implies relatively indiscriminate buying, which is what might be expected from people using passive funds to invest stimulus checks in the expectation of a big reflation. Careful judgment of exactly what earnings to expect is close to impossible, and so many judge that it is not worth bothering to try. In this environment, the normal earnings “game” of seeing whether companies can beat the expectations they have set for themselves will be largely inoperative. In the last quarter, stocks that “beat” their expectations tended to fall immediately thereafter, and that might well happen again.

Any negative surprises could have an inflated impact. Most important is inflation. Tuesday’s U.S. data will be influenced by base effects and is deemed certain to show a sharp increase. The latest reading for the annual consumer price index was 1.7%; Bloomberg’s survey of forecasters’ predictions for this month range from 2.3% to 2.7%.

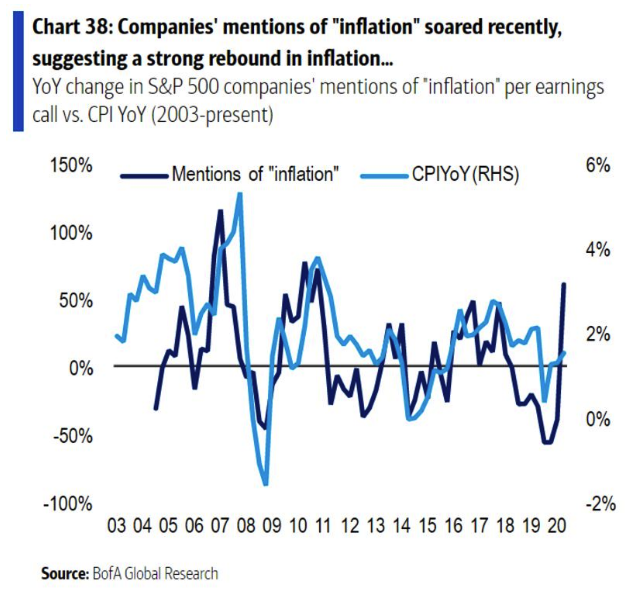

Starting Wednesday, we should also start to get more granular information on how higher costs are affecting companies. A number of industry surveys already show fast rising cost pressures. These would be a natural consequence of supply shortages and bottlenecks in the wake of a big recession, but we need to know how bad they are. Three months ago, mentions of inflation by executives on earnings calls shot up in a way not seen since the oil and commodities price spike that preceded the global financial crisis, as shown in the following chart from Savita Subramanian of BofA. Will the preoccupation with costs continue?

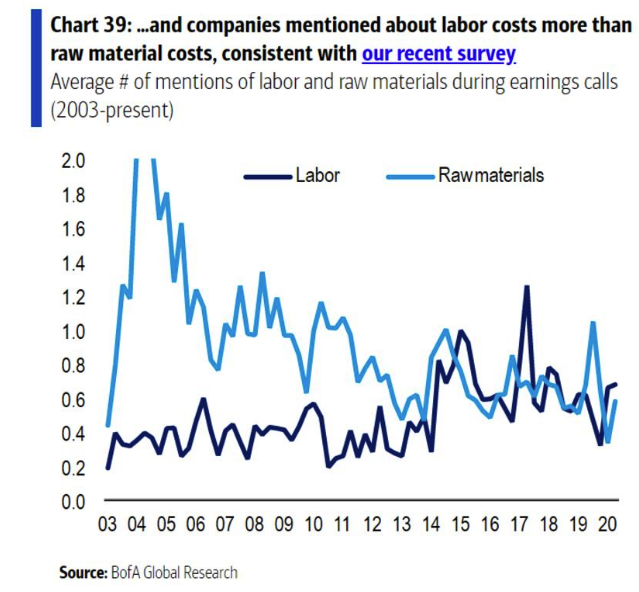

And with the vote over whether an Amazon.com Inc. facility in Alabama should unionize bringing labor costs into a newly sharp focus, it will be interesting to see what weight executives give to them relative to materials costs (which we already know have risen). It looks as though labor costs are already beginning to take over as their prime concern:

There may well be much further for the reflation trade to run. But it has come a long way in a hurry. It isn’t surprising that the market is shifting a little further away from the reflation narrative at this stage in proceedings. The next dose of corporate data could determine whether that trade can pick up again in full force.

Survival Tips

There are times when nothing but a viral clip will do. I recommend watching this, which is the American actor Mike Warburton singing and beatboxing his own cover version of Whole Lotta Love by Led Zeppelin, on Norwegian television. Here is the original, so you get an idea of how good and accurate it is. All in, beatboxing may be the perfect pandemic activity.

Warburton can also be found doing Immigrant Song, which I find even funnier. This is the one that starts with Robert Plant doing a Tarzan-style yodel, as you can see here. Immigrant Song might be my favorite Led Zep song, partly because it's less than four minutes and avoids their tendency toward self-indulgence, and partly because it turns out that the song is all about Iceland, inspired by a visit the band made to the island for a festival. Once I read through the lyrics, I discovered that it was about a rebuke to the island's leadership over the Icelandic financial crisis, 40 years ahead of time:

And now you'd better stop/ And rebuild all your ruins

Because peace and trust will win the day/ In spite of all you're losing.

Warburton also does a very good Jimi Hendrix. Other examples of great beatboxing greatly appreciated.

John Authers is a senior editor for markets. Before Bloomberg, he spent 29 years with the Financial Times, where he was head of the Lex Column and chief markets commentator. He is the author of The Fearful Rise of Markets and other books.