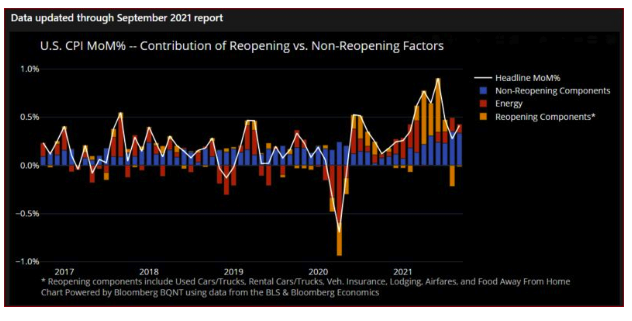

This handily shows that the “reopening” effect is dwindling with time — although still substantial — while the sectors not driven by reopening, in blue, are increasing to take up the slack.

But this is a 12-month measure, affected by base effects. This is the same exercise, conducted for month-on-month inflation:

Last month, substantially all of the increase in inflation came from sectors that were not particularly affected by the pandemic. On a month-by-month basis the pandemic effect is over, and yet inflation remains elevated.

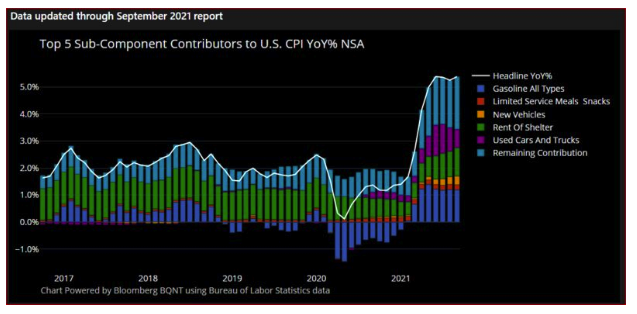

Taking things to another level of granularity, here are the five components that have contributed most to the September year-on-year number. This exercise makes clear why there is so much concern over rents and shelter inflation. It is a huge chunk of the index. Before much longer, discussions of inflation will likely say little about Covid, and will instead be dominated by rents and housing:

In short, ECAN is mighty useful. If you’re on a Bloomberg Terminal, it’s worth taking it for a test drive.

The Labor Market

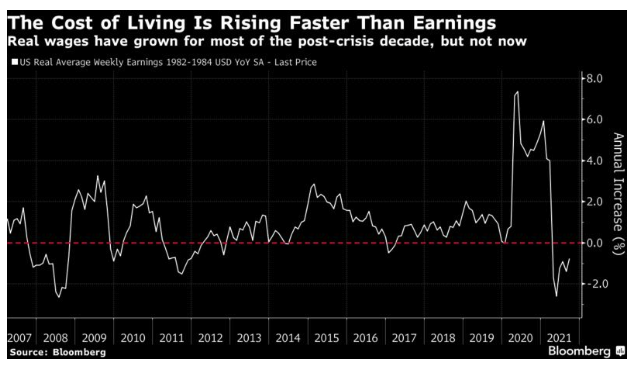

The other critical inflationary driver is the labor market. Will workers insist on higher wages to cover higher living costs, will employers pay them those wages, and will there be a new wage-price spiral? One other new data point is concerning on this point. Wages are rising, but very unusually they are failing to keep up with living costs. This is how average real weekly earnings have moved, according to the BLS:

So, if employees have any sense, they are going to ask for higher wages from here. Given the number of vacancies, it will be hard to say no to them. On the face of it, there is reason to be concerned about pressure on prices from the labor market.