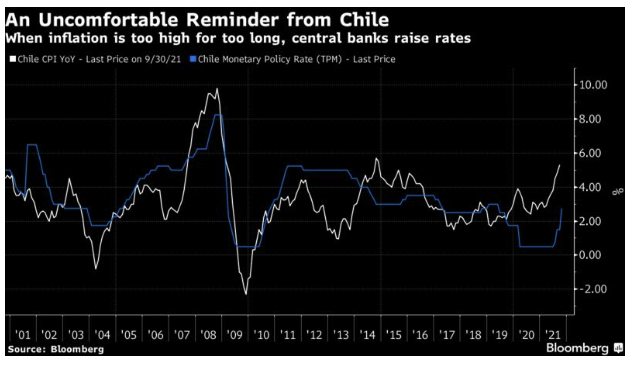

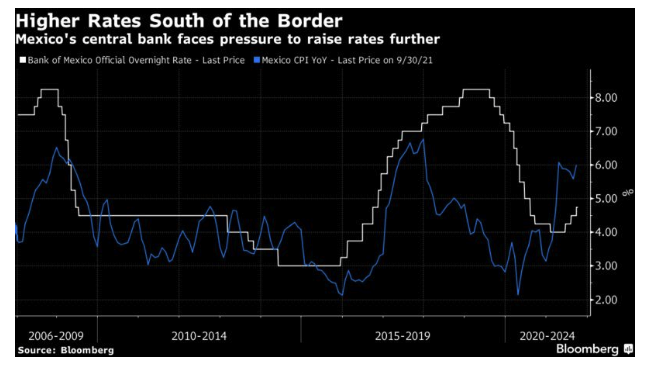

For countries without the “exorbitant privilege” of the dollar, hiking in response to elevated inflation is already a fact of life. Closer to the U.S., Mexico’s central bank has already hiked three times this year, and history suggests it will need to do so several more times.

Monetary tightening by the U.S. would add to the problems for Latin America by strengthening the dollar and putting more pressure on Latin American currencies. However, monetary tightening looks ever more likely. A few hours after the CPI data were published, the Fed published the minutes of the Federal Open Market Committee’s meeting last month, which confirmed that a start to tapering off asset purchases next month is a near certainty. It also conceded about as directly as a central bank ever can that it had underestimated the dangers of inflation:

Most participants saw inflation risks as weighted to the upside because of concerns that supply disruptions and labor shortages might last longer and might have larger or more persistent effects on prices and wages than they currently assumed.

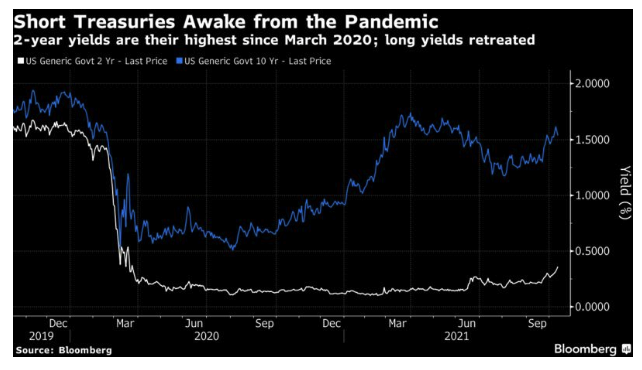

Markets took the hint. Two-year yields are their highest since March last year, when the pandemic first hit. Meanwhile, the 10-year yield retreated from an approach toward its post-pandemic high. The two-year reflects the now-strong likelihood that the Fed will raise rates within the next two years; the 10-year reflects concerns about growth. As a reaction to one day’s welter of data, that seemed reasonable:

For the future, all of this will make life more difficult for investors. More of that anon. The need to write and talk about inflation will continue.

Survival Tips

Perpetuals are Forever.

Let's get back to James Bond. I see some critics are complaining that the new movie is too long. They're Philistines.

Meanwhile, my request on Twitter for jokes about long Bond movies and long bonds (inspired by Kate Duguid of the Financial Times) yielded:

The Inflation Numbers Are Undeniable Now

October 14, 2021

« Previous Article

| Next Article »

Login in order to post a comment