The U.S. bond market took a day off to celebrate Christopher Columbus and Native Indigenous Americans, which was probably just as well. By the end of last week, the bond market was showing clear signs of losing its nerve over inflation again. Moreover, this wasn’t a uniquely American phenomenon: German inflation breakevens, the implicit inflation forecast that can be derived from the bond market, are at their highest in eight years, even if they remain below 2%. In the U.S., forecasts for both the next five years and the five years after that are close to the highs they touched during the brief inflation scare this spring:

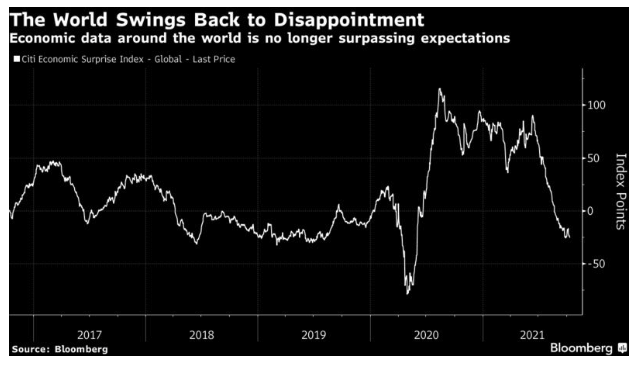

But even if there is some clarity that inflation is a problem again, it’s not because of any overheating. Incoming economic data for the world as a whole have generally been disappointing for the last few months, and on balance they are now inflicting negative surprises, as indicated by the Citi Global Surprise Index:

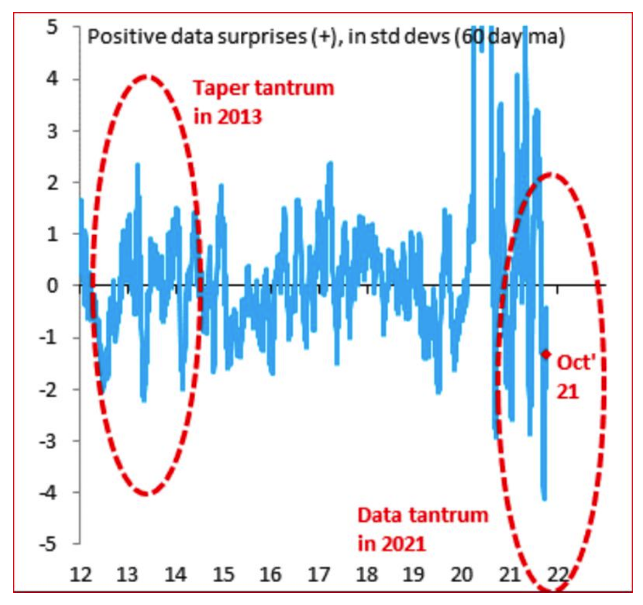

Meanwhile, in the U.S., Robin Brooks, chief economist at the Institute of International Finance, notes data surprises are now running significantly negative. Importantly, they are notably more negative than in 2013, when bond yields surged in apprehension of tapering of quantitative easing by the Federal Reserve. “The big stylized fact of the last few months is that the recovery from Covid is way slower than markets had been expecting,” Brooks said.

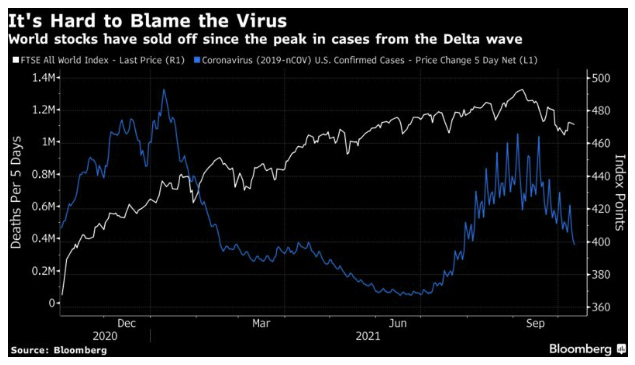

Note that he was talking about the economic recovery from the pandemic, not the medical one. After the successful vaccine tests in November 2020, almost a year ago, the stock market was able to look past the winter wave and ahead to the vaccination campaign, then began to pause with the onset of the summer delta wave in the U.S., still by far the most important economy. But in the last few weeks, the global stock market has sagged even as cases have reduced sharply:

Absent the arrival of a truly terrifying new variant that is lethal and also impervious to all the vaccines we have at present, it looks as though we have reached the point where the market is no longer that concerned about the pandemic’s medical progression. There is general optimism that it needn’t be as horrifically damaging in the future, along with pessimism that it’s bound to become endemic.

That raises the issue of just why bond yields are surging and the stock market is wobbling. Plainly the worry is that inflation is back, and it won’t be transitory. Handily, you can find the latest update of Bloomberg’s inflation indicators here. The bottom line is that inflationary pressure is indeed broadening, and this shows up most clearly in commodities markets, in the labor market, and in complaints from businesses that they are wrestling with higher prices.