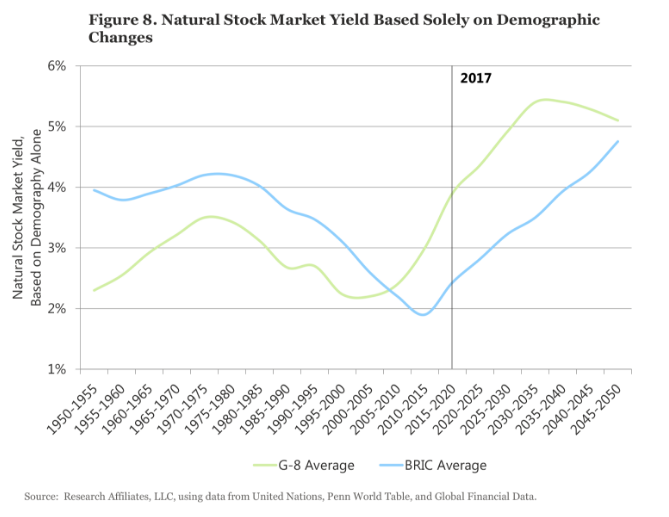

Chaves and Arnott (2012, 2013) used regressions across 30 countries, spanning 60 years, to gauge the linkage of demographic profiles with stock market returns. We have reversed this analysis in order to find the dividend yield that corresponds to those demographic profiles. When we are interpolating within demographic profiles that have been seen before, we can measure the uncertainty of our forecasts. When we are extrapolating past relationships to apply them to demographic profiles that have never been seen before, we cannot. So, extrapolation into uncharted territory is a far more dangerous use of this kind of model. Figure 8 illustrates that the high yields of the 1970s and the low yields of the 2000s were arguably a normal result of demographic pressures.

Figure 8 suggests that by 2030, yields in the developed economies may exceed 5 percent, and would likely already be on their way there now, absent the unprecedented central bank interventions we have witnessed, but which cannot be expected to continue indefinitely. Because this forecast is based on extrapolations of past relationships, it would be reckless to suggest it is in any way precise, but we believe the resulting forecast is at least directionally correct.

One offsetting condition might be that higher yields and the resulting lower market levels could easily prompt millions to defer their retirement dates, and thus mitigate the upward pressure on yields. In any event, we can confidently suggest that demographic pressures are likely to be a headwind for asset valuation levels over the next 15 to 20 years as valuation-indifferent buyers become valuation-indifferent sellers, needing to sell at whatever price is available in order to buy goods and services in retirement.

Other Influences On EPS Growth

Stock market earnings per share grow in the very long term at a rate roughly equal to the GDP per capita growth rate, not the GDP growth rate. Why not the latter? Economic growth consists of the growth of existing enterprises and the creation of new enterprises. A healthy economy will experience robust entrepreneurial capitalism, with substantial and sustained new enterprise creation. The growth of existing enterprises is therefore slower than macroeconomic growth. An investor in the broad market is diluted by both share issuance of new companies and by secondary equity offerings as existing companies look to fund new initiatives. Therefore, on average, per share earnings growth of existing companies must be slower than GDP growth.