International Evidence For CAPE Efficacy

The CAPE ratio is a powerful predictor of stock market returns, and its forecasting efficacy in the US market is amply explored and documented in the literature. (More information on why CAPE forecasts returns is provided in the appendix.) We take a look beyond the US market at CAPE’s ability to predict 10-year returns in 11 international stock markets, where its efficacy is not as well documented. Because CAPE is easy to calculate across global markets, it provides a consistent mechanism for cross-market comparisons.

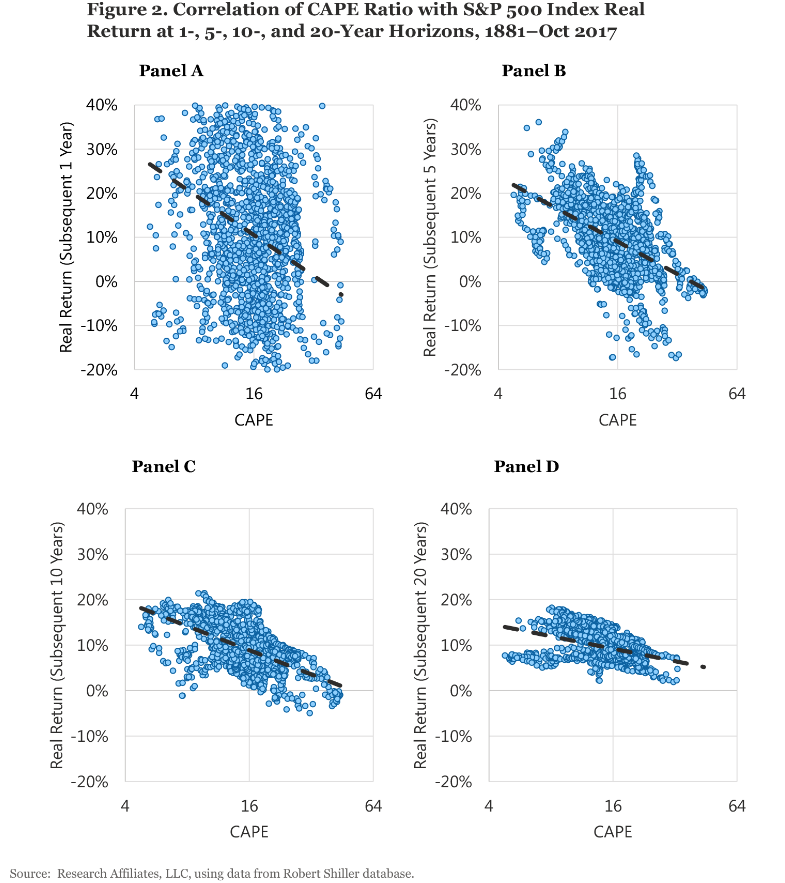

But first, let’s examine CAPE’s efficacy in the US market over horizons of 1 to 20 years. In Figure 2 we compare the starting CAPE ratio with the S&P 500 Index return at each 1-, 5-, 10-, and 20-year horizon beginning in 1881 through October 2017. The scatter plot in Panel A illustrates that the CAPE ratio does forecast return, even on a short horizon of 1 year, although the forecast has considerable uncertainty. Indeed, if the regression line wasn’t shown in Panel A, it would be difficult to discern any relationship at all. Although the short-term efficacy isn’t bad—the regression slope is steeper than for any of the longer spans—the dispersion is wide, with factors other than valuation driving short-horizon performance. As the horizon increases from 5 to 20 years (Panels B to C to D), the forecast becomes more predictive as the dispersion narrows considerably, making it easy to see why CAPE is such a popular tool for practitioners who want to gauge long-horizon market prospects. The fit is impressive enough that CAPE skeptics have some explaining to do.