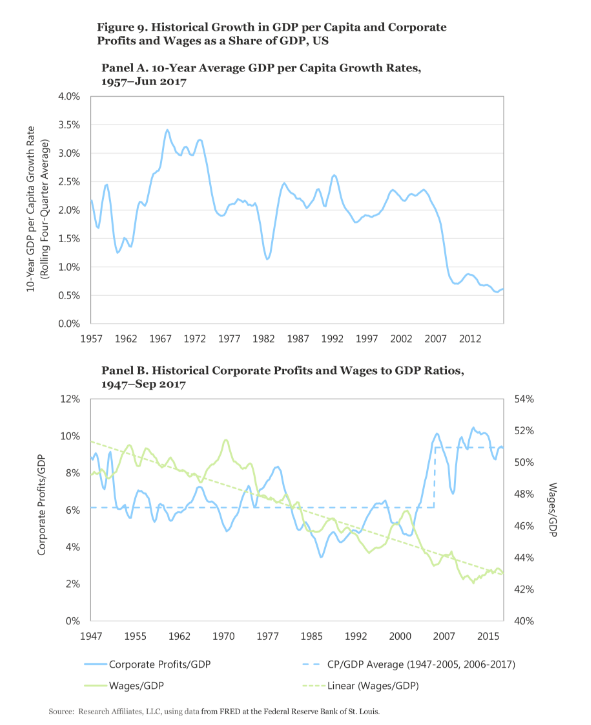

In Figure 9, Panel A, we display the 10-year average GDP per capita growth rate. In the last decade the GDP per capita growth rate was almost one percentage point lower than the post-war average. Two factors are primarily responsible for the recent slowdown in growth of GDP per capita in the United States, as well as in Europe, Japan, and the rest of the developed world:

• Slow business formation. The increasing monopolization of business and industry (cited by Grantham [2017] as impacting the future EPS growth rate) as well as the cooperation between government and established big business known as “crony capitalism” are likely limiting new business creation. The latter force can stifle entrepreneurial capitalism with a web of complex regulations and tax laws, easy for big companies to navigate, but far more difficult for start-ups to manage.

• Slowing innovation. Past innovations led the way to remarkable increases in productivity, mobility, and speed of communication. Compare the productivity-boosting impact of the internal combustion engine, electricity, railways, penicillin, indoor plumbing, telephone, radio, and the computer to the impact of newer innovations such as Twitter, Facebook, and the iPhone; the comparison pretty clearly favors the former.

Maybe earnings as a share of GDP can grow further; after all, as we can see in Figure 9, Panel B, earnings have grown handily in the last decade, from roughly 6 percent—the long-run average before 2008—to more than 9 percent in recent years. Grantham views this transition as evidence of strong earnings, justifying a higher CAPE ratio.

But will this ratio of profits to GDP keep growing in the future—a condition necessary to justify higher CAPE ratios—or will it mean revert? For profits to become a larger share of GDP, some other component of GDP would need to shrink. In the last 50 years, the shrinking element was wages and salaries. The ratio of wages to GDP has been steadily declining from about 50 percent in the 1960s to about 42 percent today. As a result, the median worker has experienced no growth in real wages since about 1980.