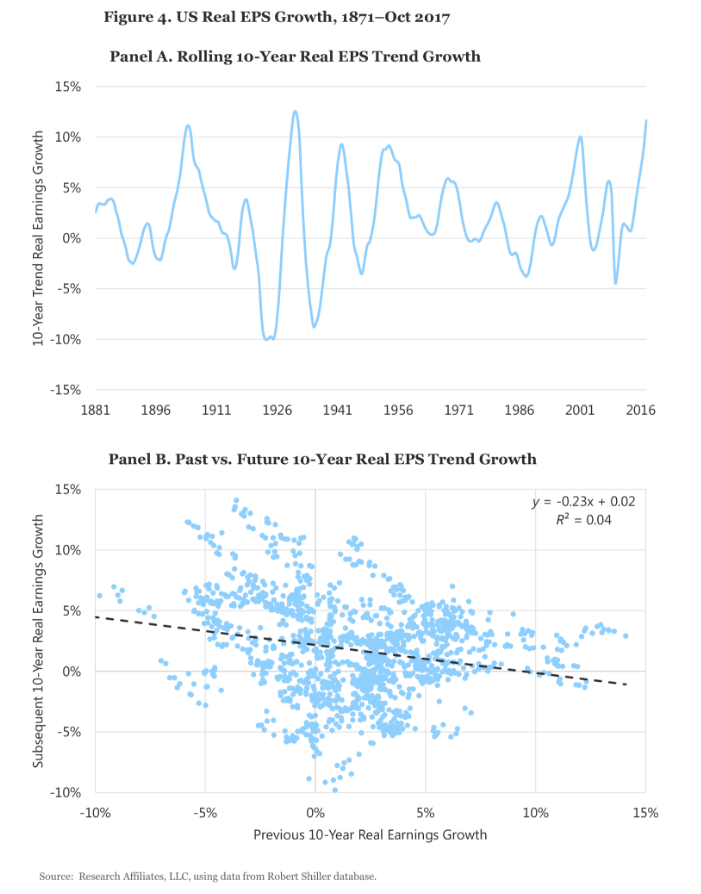

Figure 4, Panel A, clearly shows the cyclicality in trend 10-year EPS growth. And Panel B shows that, for 10-year horizons, past EPS growth does not indicate future EPS growth. Indeed, we observe a moderate negative linkage between past and future EPS growth. Shiller’s research showed that CAPE ratios do not predict future growth rates; he found that some of the strongest mean reversion in the capital markets is between past and future earnings growth rates. We do not think this time will be different.

Inaccuracies In Earnings Measurement

Wharton Professor Jeremy Siegel is one of the most outspoken critics challenging the relevance of the current high CAPE ratio in the US market. Siegel (2016), although not against using CAPE as a valuation tool, finds many problems with its denominator, the real earnings measure, which lead him to question whether the market is anywhere near as expensive as the CAPE ratio would suggest. He argues these problems with the denominator artificially boost current CAPE levels relative to historical norms. Siegel’s objections to the standard CAPE formulation fall into three categories:

1. CAPE is not robust to secular changes in real per share earnings growth.

2. Current earnings are lower as a direct consequence of changes in accounting rules.

3. Other measures of earnings may be more appropriate measures of the US economy.